Page 2

47 Percent of New Buyers Surprised by How Affordable Homes Are Today

posted by: George Sykes, Managing Broker, Worth Clark Realty on Saturday February 13, 2021

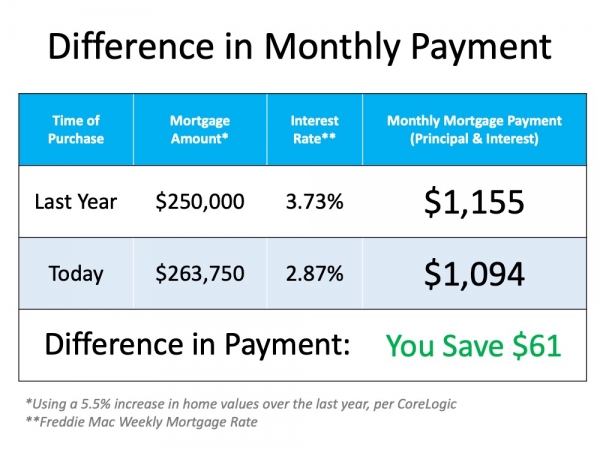

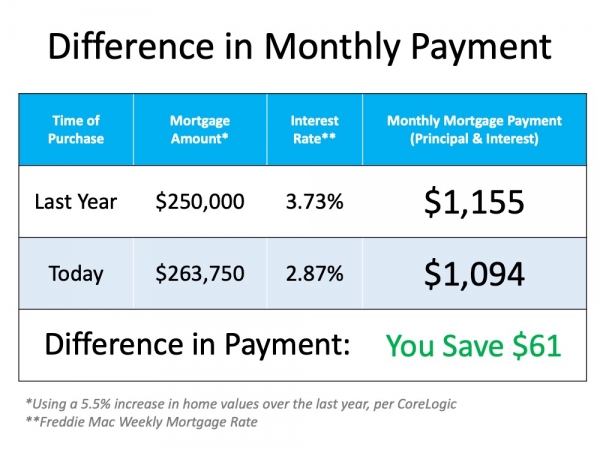

Headlines matter. Right now, it’s hard to read about real estate without seeing a headline that suggests homes have become unaffordable for most Americans. In reality, there’s hard evidence that shows how owning a home is more affordable than renting in most parts of the country, as record-low interest rates are keeping monthly mortgage payments about 23% lower than the typical payment of 20 years ago. Despite the facts, misleading headlines persist, and they impact how hopeful homebuyers perceive the market.

In a recent survey by realtor.com, home shoppers indicated they were surprised by what they could actually afford when buying their first home. In fact, 47% discovered their budget was larger than they expected. George Ratiu, Senior Economist at realtor.com, explains:

47 Percent of New Buyers Surprised by How Affordable Homes Are Today

posted by: George Sykes, Managing Broker, Worth Clark Realty on Saturday February 13, 2021

Headlines matter. Right now, it’s hard to read about real estate without seeing a headline that suggests homes have become unaffordable for most Americans. In reality, there’s hard evidence that shows how owning a home is more affordable than renting in most parts of the country, as record-low interest rates are keeping monthly mortgage payments about 23% lower than the typical payment of 20 years ago. Despite the facts, misleading headlines persist, and they impact how hopeful homebuyers perceive the market.

In a recent survey by realtor.com, home shoppers indicated they were surprised by what they could actually afford when buying their first home. In fact, 47% discovered their budget was larger than they expected. George Ratiu, Senior Economist at realtor.com, explains:

What Happens When Homeowners Leave Their Forbearance Plans?

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday January 29, 2021

According to the latest report from Black Knight, Inc., a well-respected provider of data and analytics for mortgage companies, 6.48 million households have entered a forbearance plan as a result of financial concerns brought on by the COVID-19 pandemic. Here’s where these homeowners stand right now:

2,543,000 (39%) are current on their payments and have left the program

625,000 (9%) have paid off their mortgages

434,000 (7%) have negotiated a repayment plan and have left the program

2,254,000 (35%) have extended their original forbearance plan

512,000 (8%) are still in their original forbearance plan

116,000 (2%) have left the program and are still behind on payments

What Happens When Homeowners Leave Their Forbearance Plans?

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday January 29, 2021

According to the latest report from Black Knight, Inc., a well-respected provider of data and analytics for mortgage companies, 6.48 million households have entered a forbearance plan as a result of financial concerns brought on by the COVID-19 pandemic. Here’s where these homeowners stand right now:

2,543,000 (39%) are current on their payments and have left the program

625,000 (9%) have paid off their mortgages

434,000 (7%) have negotiated a repayment plan and have left the program

2,254,000 (35%) have extended their original forbearance plan

512,000 (8%) are still in their original forbearance plan

116,000 (2%) have left the program and are still behind on payments

Smart Buyers and Smart Sellers: Class #3 "The Contract"

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday January 1, 2021

George Sykes, Real Estate Broker with Worth Clark Realty details what every real estate buyer and seller should know about the "Contract To Purchase Real Estate". Buyers and Sellers owe it to themselves to watch this video before they sign their next real estate contract. Understand what you are signing. George Sykes is a licensed Real Estate Broker in Southern Illinois and represents clients in edwardsville, glen carbon, collinsville, granite city, maryville, troy, ofallon, swansea, shiloh and belleville.

Read Full Article ...Smart Buyers and Smart Sellers: Class #3 "The Contract"

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday January 1, 2021

George Sykes, Real Estate Broker with Worth Clark Realty details what every real estate buyer and seller should know about the "Contract To Purchase Real Estate". Buyers and Sellers owe it to themselves to watch this video before they sign their next real estate contract. Understand what you are signing. George Sykes is a licensed Real Estate Broker in Southern Illinois and represents clients in edwardsville, glen carbon, collinsville, granite city, maryville, troy, ofallon, swansea, shiloh and belleville.

Read Full Article ...Smart Buyers and Smart Sellers: Class #2

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday December 18, 2020

Class #2: The Listing Agreement

In Smart Buyer and Smart Seller Class #2, George explains what exactly goes into a Listing agreement. This document details key elements of a real estate sale like Price, Commissions, Timing, what stays with the house and Disclosures. If you are selling a property in the Southern Illinois area (edwardsville, glen carbon, collinsville, granite city, maryville, troy, ofallon, swansea, shiloh, belleville) this course is a must see before you list.

Smart Buyers and Smart Sellers: Class #2

posted by: George Sykes, Managing Broker, Worth Clark Realty on Friday December 18, 2020

Class #2: The Listing Agreement

In Smart Buyer and Smart Seller Class #2, George explains what exactly goes into a Listing agreement. This document details key elements of a real estate sale like Price, Commissions, Timing, what stays with the house and Disclosures. If you are selling a property in the Southern Illinois area (edwardsville, glen carbon, collinsville, granite city, maryville, troy, ofallon, swansea, shiloh, belleville) this course is a must see before you list.

Smart Buyers and Smart Sellers: Class #1

posted by: George Sykes, Managing Broker, Worth Clark Realty on Monday December 14, 2020

Real Estate Master Class: Smart Buyers and Smart Sellers

Class #1: Must See Class for Anyone Buying and Selling a Home

Join George as he teaches homeowners, buyers and sellers what they should know before buying or selling a property. This Free Class explains the timeline for both the buyer and the seller and creates a foundation for the "Smart Buyer Smart Seller Real Estate Master Class" series.

Smart Buyers and Smart Sellers: Class #1

posted by: George Sykes, Managing Broker, Worth Clark Realty on Monday December 14, 2020

Real Estate Master Class: Smart Buyers and Smart Sellers

Class #1: Must See Class for Anyone Buying and Selling a Home

Join George as he teaches homeowners, buyers and sellers what they should know before buying or selling a property. This Free Class explains the timeline for both the buyer and the seller and creates a foundation for the "Smart Buyer Smart Seller Real Estate Master Class" series.

Homeownership Helps the Local Economy

posted by: George Sykes, Managing Broker, Worth Clark Realty on Saturday November 28, 2020

Each real estate transaction makes an impact on the local economy, which is a major part of why the housing market is a driver in this year’s economic recovery. This winter is a great time to make a move, so DM me if you’re ready to support our community and find your dream home today.

Read Full Article ...Homeownership Helps the Local Economy

posted by: George Sykes, Managing Broker, Worth Clark Realty on Saturday November 28, 2020

Each real estate transaction makes an impact on the local economy, which is a major part of why the housing market is a driver in this year’s economic recovery. This winter is a great time to make a move, so DM me if you’re ready to support our community and find your dream home today.

Read Full Article ...Why Working from Home May Spark Your Next Move

posted by: George Sykes, Managing Broker, Worth Clark Realty on Monday November 16, 2020

If you’ve been working from home this year, chances are you’ve been at it a little longer than you initially expected. Businesses all over the country have figured out how to operate remotely to keep their employees healthy, safe, and productive. For many, it may be carrying into next year, and possibly beyond.

Read Full Article ...Why Working from Home May Spark Your Next Move

posted by: George Sykes, Managing Broker, Worth Clark Realty on Monday November 16, 2020

If you’ve been working from home this year, chances are you’ve been at it a little longer than you initially expected. Businesses all over the country have figured out how to operate remotely to keep their employees healthy, safe, and productive. For many, it may be carrying into next year, and possibly beyond.

Read Full Article ...Do You Need to Know More about Forbearance and Mortgage Relief Options?

posted by: George Sykes, Managing Broker, Worth Clark Realty on Monday October 19, 2020

Earlier this year when the nation pressed pause on the economy and unemployment rates jumped up significantly, many homeowners were immediately concerned about being able to pay their mortgages, and understandably so. To assist in this challenging time, two protection plans were put into place to help support those in need.

First, there was a pause placed on initiating foreclosures for government-backed loans. This plan started on March 18, 2020, and it extends at least through December 31, 2020. Second, homeowners were able to obtain forbearance for up to 180 days, followed by a potential extension for up to another 180 days. This way, there is a relief period in which homeowners have the opportunity to halt payments on their mortgages for up to one year.

Do You Need to Know More about Forbearance and Mortgage Relief Options?

posted by: George Sykes, Managing Broker, Worth Clark Realty on Monday October 19, 2020

Earlier this year when the nation pressed pause on the economy and unemployment rates jumped up significantly, many homeowners were immediately concerned about being able to pay their mortgages, and understandably so. To assist in this challenging time, two protection plans were put into place to help support those in need.

First, there was a pause placed on initiating foreclosures for government-backed loans. This plan started on March 18, 2020, and it extends at least through December 31, 2020. Second, homeowners were able to obtain forbearance for up to 180 days, followed by a potential extension for up to another 180 days. This way, there is a relief period in which homeowners have the opportunity to halt payments on their mortgages for up to one year.

The Cost of a Home Is Far More Important than the Price

posted by: George Sykes, Managing Broker, Worth Clark Realty on Tuesday September 29, 2020

Housing inventory is at an all-time low. There are 39% fewer homes for sale today than at this time last year, and buyer demand continues to set records. Zillow recently reported: ...

Read Full Article ...The Cost of a Home Is Far More Important than the Price

posted by: George Sykes, Managing Broker, Worth Clark Realty on Tuesday September 29, 2020

Housing inventory is at an all-time low. There are 39% fewer homes for sale today than at this time last year, and buyer demand continues to set records. Zillow recently reported: ...

Read Full Article ...Busey Wealth Management Expands Services in Metro East

posted by: Busey Bank on Tuesday September 22, 2020

Team Adds Advisors to Serve Clients in Madison, St. Clair and Surrounding Counties

Busey Wealth Management has expanded services in the Metro East while recently adding several new team members to help serve the needs of clients throughout Madison, St. Clair and surrounding counties.

Busey Wealth Management Expands Services in Metro East

posted by: Busey Bank on Tuesday September 22, 2020

Team Adds Advisors to Serve Clients in Madison, St. Clair and Surrounding Counties

Busey Wealth Management has expanded services in the Metro East while recently adding several new team members to help serve the needs of clients throughout Madison, St. Clair and surrounding counties.

Menu

Worth Clark Realty's

Featured Homes For Sale

Sell Your Home Here

There is only one way to put your home listing here, on the home page of chesterfield365.com, and that is to list with Worth Clark Realty. Text 618-531-4000 to find out how.